Tax Planning

“The hardest thing in the world to understand is the Income Tax…”

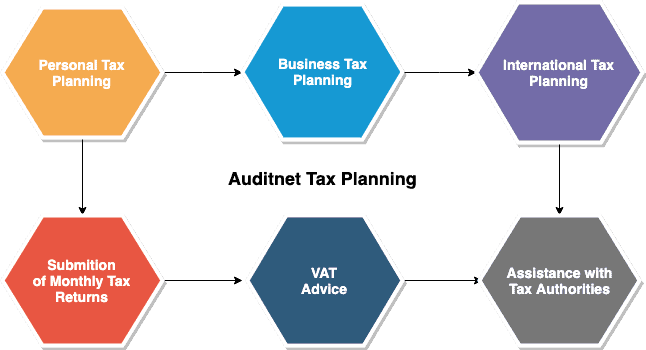

Our Tax Planning services:

• Personal Tax Planning

• Business Tax Planning

• International Tax Planning

• Preparation and submission of monthly tax returns

• Shipping Accounting Services

• Assistance in dealing with tax authorities

• Value Added Tax (VAT) advice and other Tax advice

Personal Tax Planning

Our team of tax advisors will take the time to look into your own personal situation and offer effective advice by taking into consideration the tax regulations and legislations which affect you. Given the complexity of the matter, appropriate professional advice can significantly reduce your tax exposure.

By identifying suitable opportunities and implementing efficient strategies, your personal wealth and assets can be effectively protected.

Due to our extensive knowledge of the tax system, our tax advisors can help you implement the proper structures to minimise the amount of capital gains tax and/or inheritance tax which could become due and limit your income tax exposure.

Business Tax Planning

Business decisions can largely impact a company’s tax liability. Sound and efficient business tax planning undoubtedly results in more effective and efficient business structures.

We have a sound knowledge of numerous tax regimes and can advise you on all your corporate tax planning needs which could result in minimising your tax liability.

International Tax Planning

By using appropriate measures and utilising different structures from the tax systems of various jurisdictions, tax liabilities can be drastically reduced.

In today’s increasingly globalised world, sound tax planning is important both for businesses as well as individuals.

Our experienced tax consultants work closely with professionals in many jurisdictions and are thus able to offer a broad range of structures and identify efficient solutions for effective tax strategies to ensure long term sustainability, asset protection, and fiscal growth.

Preparation and submission of monthly tax returns

Throughout the tax year there are certain deadlines which must be met for the preparation and submission of documentation to the tax authorities. We will ensure that these filing deadlines are met to avoid unnecessary penalties being imposed.

Shipping Accounting Services

Like other areas of shipping accounting, accounting for shipping has its own regulations and standards that have to be followed to be able to adequately offer accounting within the shipping industry. We have a team of professionals with a particular shipping interest who remain up to date with the relevant standards and regulations related to the shipping industry and who are well equipped to assist you with all your regarding shipping needs.

Assistance in dealing with tax authorities

Tax authorities globally are becoming increasingly difficult to deal with and examine closely all information given to them. Even a minor error can cause the tax authorities to require more information on a particular individual or business transaction. This is why an appropriate tax planning from the outset is necessary to help protect you from such instances.

In cases where the tax authorities do become involved, our consultants will handle all correspondence and dealings with the authorities on your behalf thereby eliminating this daunting procedure for you and ensuring that your case is successfully dealt with.

Value Added Tax (VAT) advice and other Tax advice

Undoubtedly, value added tax (VAT) can be one of the most challenging aspects of taxation. VAT legislation is particularly complex and is constantly amended and updated.

Our dedicated team remains informed and up to date with VAT legislation both in Cyprus as well within the European Union and can offer tailored advice to your specific needs.

Timely responses to the ever-changing tax legislation and the appropriate implementation of effective strategies can ensure your business will remain compliant with legislation.

Amongst others, we can advise you on matters of national and international VAT transactions; assist with VAT due diligence; VAT audits and appeal procedures; examine your VAT compliance obligations; assist with VAT registrations and applications.

CONTACT FORM

Ready to talk with one of our experts?

We work with ambitious companies from all around the world who want to reach their business goals. Together, we can shape your business future and achieve extraordinary results.

Our Business Services